CEOs should now have seen a clear picture of their first quarter results. Sudden shut downs, pivots and strategic pirouettes mean that year-over-year comparisons are mostly meaningless. Predicting future quarters may require a magic eight ball.

The next quarterly call is likely going to require a sharp departure from past approaches, and presents an opportunity to hit reset on the short-term, tactical bent that typically plagues them.

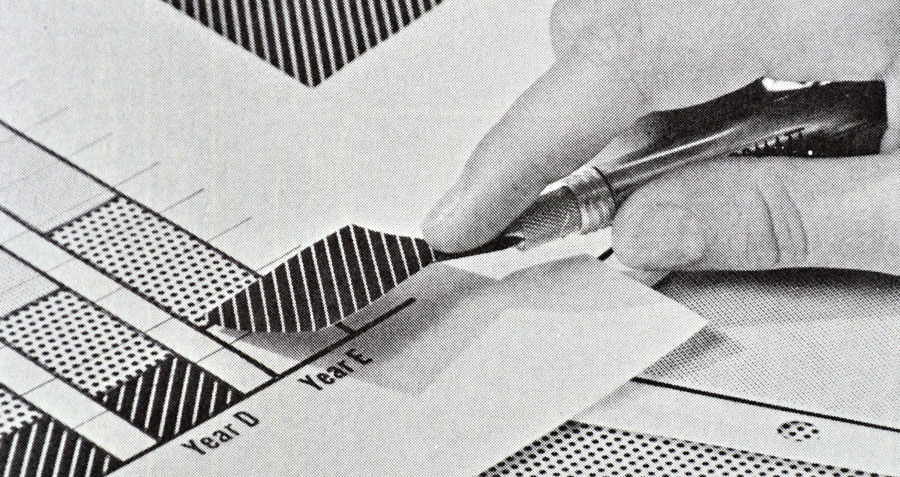

Take the a scalpel to the template.

Cut:

- Repeating the results paragraphs from the press release. They have the press release. And the charts.

- Anything that tries to gloss over poor results. If sales fell off a cliff, don’t try to pretend otherwise. Don’t be “disappointed.” It is what it is, and dressing it up will taint your credibility.

- Any attempt at forecasting the rest of the year.

- Your old risks and opportunities narrative. What are you worrying about or watching carefully? How is your supply chain? Do you see a long-term shift in supply and demand for your business? Do you see an opportunity to pivot? To leapfrog competitors? This is the time to show your strategic mindset, and demonstrate you’re not panicking.

Add:

- Discussion of your balance sheet. How much cash do you have, and how fast are you burning it? What credit do you have available? Worried companies may be inclined to avoid this discussion, telling themselves all the information is in the MD&A. But again, what will that do to your credibility?

- Context. What are the issues that are facing your whole industry? Are you faring better or worse than your competitors and why?

- What you’ve done to take care of your employees, business partners, and the community. So many CEOs have demonstrated leadership through this crisis. In many cases, that has cost money. Be proud of the investments you’ve made in your community, in your people, in your clients. This sort of leadership will pay dividends.

- Comment on the stewardship of any money you’ve received from the government to manage through the crisis. You know that scrutiny over executive compensation, dividends and buybacks is going to be high. Get ahead of it.

And here’s the hard part.

What do you want to say about this moment that the world is in? Do you have something to say about the role of business and CEOs in supporting the recovery? In prioritizing the health of our community over profit? Do you have something to say about the help your business or industry needs from government? About what you will prioritize as you ramp up operations again?

This is the time to say it. While the quarterly conference call isn’t the only place, or even the best place, to show people the kind of leader you want to be, you have an opportunity to reset your call to focus on strategy, long-term value, and leadership, and pull yourself out of the tyranny of focusing on analyst expectations at the expense of strategic execution.